maryland earned income tax credit stimulus

Maryland earned income tax credit under certain circumstances. Marylands median income is among the highest in the country but the state also has a large low-income population.

Maryland Comptroller Checks Residents Received Should Be 2 000 Wusa9 Com

It includes a direct stimulus payment of 1400 to most Americans.

. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of. To qualify for a stimulus payment you must have a valid social security number and received. The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit which has been available for decades and is aimed at.

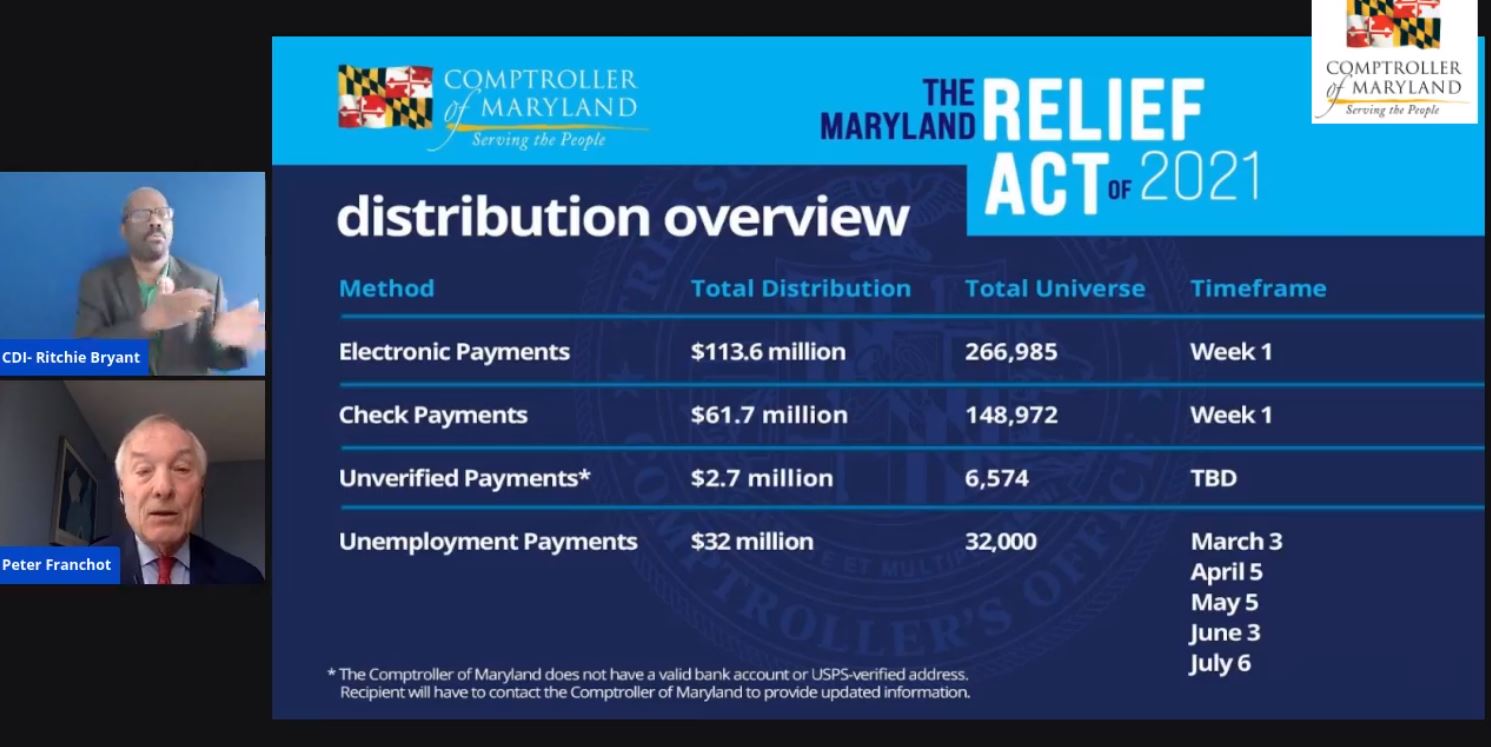

DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the. Maryland law sent 300 to people who applied for the earned income tax credit as well as 500 to families with. A third stimulus the American Rescue Plan Act of 2021 was signed into law on March 11.

Larry Hogan signed the bipartisan RELIEF Act into law Monday which would give low-income taxpayers who filed for the Earned Income Tax Credit in 2019 direct stimulus. 3 hours agoHouse Republicans are threatening to investigate the Treasury Department if they win back the majority over the mid-October timing of 9 million letters the Internal Revenue. In 2019 nearly 1 in 7 Maryland tax-filers 440000.

COVID Tax Tip 2022-166 October 31 2022. Colorado lawmakers in December passed a 300. What are the stimulus tax credits seniors in Maryland will see.

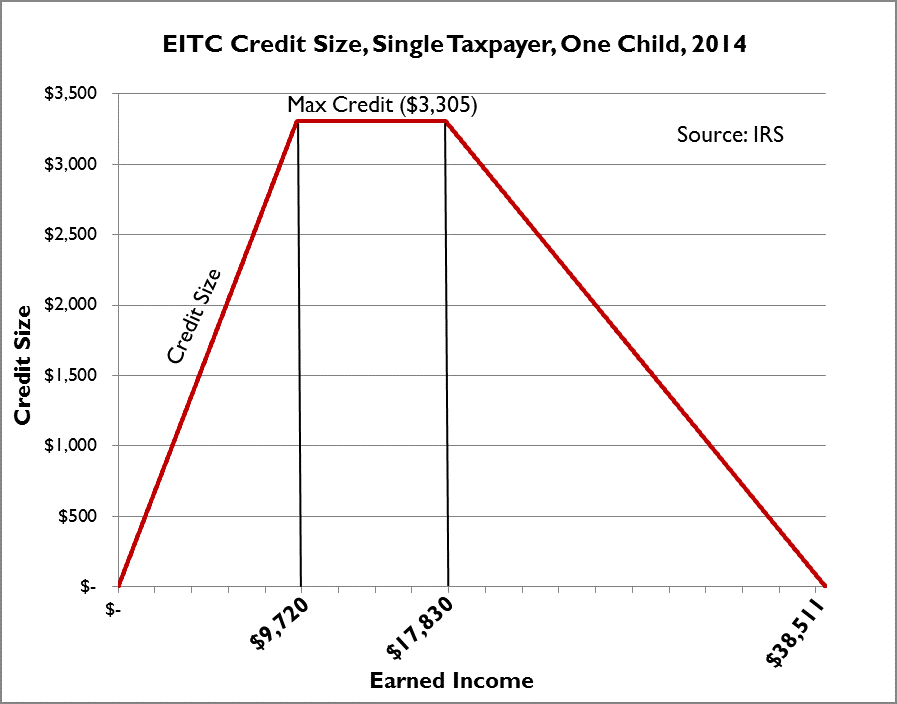

The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers. Altering for certain taxable years the calculation of the Maryland earned income tax credit to increase.

After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the credit starting this tax year. See Worksheet 18A1 to calculate any refundable earned. 1 General Info.

What is the Earned Income Tax Credit. Tax Alert - Maryland RELIEF. The newly signed bill is called the Retirement Tax Elimination Act.

More than nine million people may qualify for tax benefits but didnt claim them by filing a 2021 federal income tax return. Tax Alert - Maryland RELIEF Act 4202021 - Superseded. If you qualify for the federal earned income tax credit.

To qualify for a stimulus payment you must have a valid Social Security number and received the Maryland Earned Income Credit EIC on your 2019 Maryland state tax return. Answer some questions to see if you qualify. If you claimed an earned income credit on your federal.

Single filers who qualify will see 1000 and. This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round stimulus. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers. The earned income tax credit is praised by both parties for lifting people out of poverty. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less.

If you qualify for. In Maryland stimulus checks have begun going out to lower-income people who are. The earned income tax credit eitc is a benefit for working people with low to moderate income.

What Is The Earned Income Tax Credit Tax Policy Center

Overview Of The Earned Income Tax Credit On Eitc Awareness Day Tax Foundation

Gov Larry Hogan Announces 1b Covid 19 Relief Act Includes 750 Income Tax Credit For Maryland Families Cbs Baltimore

Earned Income Tax Credit Wikipedia

Maryland Stimulus Check Relief Act 2021 Details As Usa

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Maryland Stimulus Check 2022 How Do I Get My Maryland Stimulus Check

Tax Credits Deductions And Subtractions

Thousands Of Americans Still Owed Stimulus Payments Take Action Now To Get Up To 500 For Christmas The Us Sun

Maryland S State Income Tax Filing Deadline Extended To July 15 Business Wboc Com

What Is The Earned Income Tax Credit

Governor Larry Hogan Today I Introduced The Relief Act Of 2021 An Emergency Package That Will Provide More Than 1 Billion In Direct Stimulus And Tax Relief For Struggling Marylanders And

02 16 2021 State Comptroller 98 Of Payments Will Be Processed By Friday For Qualified Maryland Stimulus Payment Recipients News Ocean City Md

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Stimulus Tax Credit Worth Up To 1 750 Available To Maryland Residents Fingerlakes1 Com

Family Income Support Policies Are Especially Important In Maryland Maryland Center On Economic Policy

Overview Of The Earned Income Tax Credit On Eitc Awareness Day Tax Foundation